Class 3 DSC India 2025: Complete Registration Guide

Complete Guide to Class 3 Digital Signature Certificates (DSC)

Introduction: Why Every Business Needs a Class 3 DSC in 2025

Can't file your company's annual returns on the MCA V3 Portal? Facing authentication errors on the GST Portal? The solution is a valid Class 3 Digital Signature Certificate (DSC).

Zero-Click Answer: A Class 3 Digital Signature Certificate is a legally valid electronic authentication mechanism issued by licensed Certifying Authorities under the Controller of Certifying Authorities (CCA), mandatory for ROC filings, GST returns (for specific taxpayers), e-tendering, and income tax compliance. As of 2024, only Class 3 DSCs are valid—Class 2 certificates have been discontinued.

Since July 2024, the Indian government implemented stricter Identity Verification Guidelines (IVG), requiring video KYC verification and direct invoicing from Certifying Authorities. This guide covers everything you need to know about obtaining, registering, and troubleshooting Class 3 DSCs in 2025.

What is a Class 3 Digital Signature Certificate?

A Class 3 Digital Signature Certificate is the highest level of digital authentication available to individuals and organizations in India. It provides both signing and encryption capabilities, ensuring the authenticity and integrity of electronic documents submitted to government portals.

Key Features of Class 3 DSC:

Legal Validity: Recognized under the Information Technology Act, 2000

Dual Functionality: Available as "Class 3 Signing Only" or "Class 3 Sign & Encrypt"

High Assurance: Requires physical verification and biometric authentication

Regulatory Compliance: Mandatory for MCA, GST, and income tax filings

USB Token Storage: Stored on encrypted hardware devices (epass2003, epass2003Auto)

Why Class 2 DSCs Are No Longer Valid

As of 2024, the Controller of Certifying Authorities (CCA) discontinued Class 2 certificates for all government portal authentications. All existing Class 2 DSC holders must upgrade to Class 3 for continued compliance.

Types of Class 3 Digital Signature Certificates

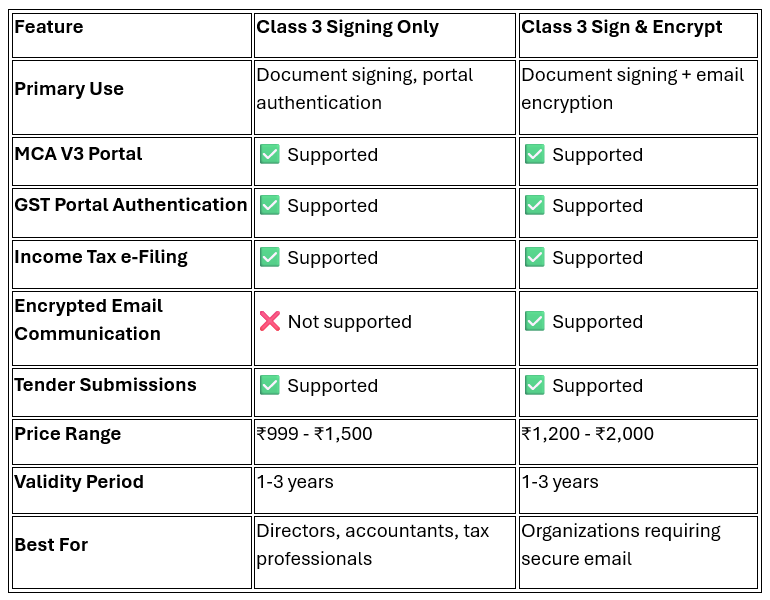

Understanding the difference between DSC types ensures you purchase the right certificate for your specific needs.

Class 3 Signing vs. Class 3 Sign & Encrypt: Comparison Table

Organization vs. Individual DSC

Individual DSC: Issued in the name of a person (director, partner, proprietor)

Organization DSC: Issued in the company's name for institutional filings

Recommendation: Directors should obtain individual DSCs with their DIN (Director Identification Number)

Who Needs a Class 3 Digital Signature Certificate in 2025?

Mandatory Requirements:

Company Directors: For filing annual returns, board resolutions, and compliance forms on MCA V3 Portal

Chartered Accountants: For signing audit reports and certifications

Company Secretaries: For statutory filings and compliance certificates

GST Taxpayers: Businesses with aggregate turnover exceeding ₹5 crores (for specific return forms)

Income Tax Assessees: For filing returns above specified threshold limits

Government Contractors: For e-tendering and e-procurement portals

Import-Export Code Holders: For DGFT portal submissions

Optional but Recommended:

Practicing professionals (lawyers, cost accountants)

Authorized signatories of LLPs and partnerships

Trademark and patent applicants

How to Obtain a Class 3 DSC: Complete Step-by-Step Process (2025)

The July 2024 IVG guidelines introduced mandatory video KYC verification for all DSC applications. Here's the updated process:

Step 1: Choose a Licensed Certifying Authority

Select a CCA-licensed Certifying Authority. Popular options include:

eMudhra (emSigner platform)

Sify Technologies

nCode Solutions

Capricorn Identity Services

IDRBT (Institute for Development and Research in Banking Technology)

Step 2: Select DSC Type and Validity

Certificate Type: Class 3 Signing or Class 3 Sign & Encrypt

Validity Period: 1 year, 2 years, or 3 years

USB Token: epass2003 or epass2003Auto (hardware device)

Step 3: Complete the Online Application

Visit your chosen CA's website

Fill the application form with accurate details:

Full name (as per PAN card)

PAN number

Email address and mobile number

Organization details (if applicable)

DIN (for directors)

Step 4: Upload KYC Documents

Mandatory Documents:

PAN Card (mandatory identity proof)

Aadhaar Card (address and identity verification)

Photograph (passport-size, recent)

For Directors: DIN Approval Letter

For Organizations: Certificate of Incorporation

Document Specifications:

Format: PDF or JPG

Size: Maximum 2 MB per document

Quality: Clear, legible scans

Step 5: Video KYC Verification (Post-July 2024 Requirement)

As per the updated IVG guidelines:

Schedule a video KYC appointment with the CA

Keep original documents ready for verification

Ensure stable internet connection and proper lighting

The CA representative will verify your identity and documents live

Process duration: 10-15 minutes

Step 6: Payment and Invoice

Make payment through secure gateway

The Certifying Authority will issue a direct invoice (mandatory as per July 2024 guidelines)

Payment methods: Net banking, credit/debit card, UPI

Step 7: DSC Issuance and Delivery

Processing time: 3-7 working days after successful video KYC

You'll receive the USB token via courier at your registered address

The token contains your encrypted digital certificate

Cost Breakdown (2025):

Class 3 Signing (1 year): ₹999 - ₹1,200

Class 3 Signing (2 years): ₹1,599 - ₹1,999

Class 3 Sign & Encrypt (1 year): ₹1,200 - ₹1,500

USB Token: ₹300 - ₹500 (one-time cost, reusable)

Video KYC charges: Usually included in the certificate cost

How to Register Class 3 DSC on Government Portals

Obtaining the DSC is only half the process. You must register it on each portal where you'll use it.

Registration on MCA V3 Portal (Ministry of Corporate Affairs)

Prerequisites:

Active user account on MCA portal

DSC with valid DIN linked

Java 8 Update 201 or higher installed

DSC Management Utility installed

Step-by-Step Process:

Install Required Software:

Download Java from the official MCA portal

Install the DSC Management Utility from MCA website

Ensure your browser allows Java applets

Login to MCA Portal:

Visit https://www.mca.gov.in

Navigate to MCA Services → e-Filing

Login with your credentials

Register DSC:

Go to "My Profile" or "Manage DSC"

Insert your USB token

Click "Register DSC"

Select your certificate from the dropdown

Enter the token password (default: often "12345678" or "password")

Submit for verification

Verification:

MCA system validates the certificate

Confirmation appears within 24-48 hours

You can now file forms using this DSC

Common Error: "DSC not detected" - Solution: Reinstall Java, clear browser cache, or use Internet Explorer in compatibility mode.

Registration on GST Portal

Step-by-Step Process:

Login to GST Portal:

Visit https://www.gst.gov.in

Login with GSTIN and password

Navigate to DSC Management:

Go to "My Profile"

Select "Manage DSC"

Register DSC:

Install emSigner utility (mandatory for GST portal)

Download from GST portal's resources section

Insert USB token

Click "Register DSC"

Verify certificate details

Submit

Activation:

OTP will be sent to registered mobile and email

Enter OTP to complete registration

DSC is now active for GST return filing

Important: For GST authentication, ensure your DSC contains the same PAN linked to your GSTIN.

Registration on Income Tax e-Filing Portal

Step-by-Step Process:

Login to Income Tax Portal:

Login with PAN and password

Register DSC:

Go to "My Profile" → "Manage DSC"

Install the Validate DSC utility from portal

Insert USB token

Click "Register Digital Signature"

Select certificate and verify

Verification:

System validates the certificate against PAN

Confirmation displayed immediately

DSC ready for return filing and audit report submission

Essential Software and Utilities for DSC Usage

To use your Class 3 DSC effectively, you must install specific software on your computer.

Mandatory Software Installations:

Java Runtime Environment (JRE):

Version: Java 8 Update 201 or higher

Purpose: Portal authentication and certificate detection

Download: From official portal resources or java.com

Platform: Windows, Mac, Linux

emSigner Utility:

Purpose: DSC signing and encryption for GST and other government portals

Download: From eMudhra website or GST portal

Features: WebSocket-based signing, bulk signing, PDF signing

Compatibility: Works with all major browsers (Chrome, Firefox, Edge)

DSC Management Utility:

Purpose: Certificate registration and management on MCA portal

Download: From MCA website

Platform: Windows only

USB Token Driver:

Type: SafeNet epass2003 driver

Purpose: Enables computer to detect USB token

Download: From your CA's website or SafeNet website

PDF Signing Software (Optional):

Adobe Acrobat Reader DC (for PDF signing)

Alternate: eSign application by CAs

Browser Compatibility (2025):

Best Performance: Google Chrome (latest version) with emSigner extension

MCA Portal: Internet Explorer 11 (compatibility mode) or Edge IE mode

GST Portal: Chrome, Firefox, Edge (with emSigner WebSocket service)

Income Tax Portal: Chrome, Firefox, Safari (with Java enabled)

Troubleshooting Common Class 3 DSC Errors

Error 1: "Digital Signature Certificate Not Detected"

Causes:

USB token not properly inserted

USB token driver not installed

Java not installed or outdated

Browser blocking Java applets

Solutions:

Reinsert USB token and restart computer

Install SafeNet epass2003 driver from CA's website

Update Java to version 8 Update 201 or higher

Add portal website to Java exception list:

Open Java Control Panel

Go to Security tab

Click "Edit Site List"

Enable Java in browser settings

Clear browser cache and cookies

Error 2: "Certificate Chain Not Trusted" or "Root Certificate Error"

Causes:

Root and intermediate certificates not installed

Expired CA certificates

Solutions:

Download root and intermediate certificates from your CA's website

Install certificates in Windows Certificate Store:

Open "certmgr.msc" (Certificate Manager)

Import root certificate to "Trusted Root Certification Authorities"

Import intermediate certificate to "Intermediate Certification Authorities"

Restart browser and try again

Error 3: "PAN Mismatch Error" on GST Portal

Causes:

DSC PAN differs from GSTIN-linked PAN

Incorrect PAN mentioned during DSC application

Solutions:

Verify PAN in DSC certificate:

Double-click USB token icon in system tray

View certificate details

Check "Subject" field for PAN

If PAN is incorrect, contact your CA for certificate revocation and reissuance

Ensure GSTIN and DSC PAN are identical

Error 4: "emSigner WebSocket Not Running"

Causes:

emSigner utility not installed or not running

Firewall blocking WebSocket connection

Port conflict

Solutions:

Install latest version of emSigner from eMudhra website

Ensure emSigner service is running:

Open Task Manager (Windows)

Check for "emSignerService" process

Add firewall exception for emSigner

Check if port 6600 is available (default emSigner port)

Restart emSigner service

Error 5: "DSC Validity Expired"

Causes:

Certificate crossed expiry date

Time synchronization issue

Solutions:

Check certificate validity:

View certificate properties from USB token

Note "Valid From" and "Valid To" dates

If expired, apply for DSC renewal from your CA

Sync system date and time with internet time server

Renewal process: Similar to new application, but faster processing (2-3 days)

Error 6: "Incorrect Password" or "Token Locked"

Causes:

Wrong token password entered multiple times

Token locked after 5-10 incorrect attempts

Solutions:

Use correct password (check documentation from CA)

If locked, contact your CA for PUK (Personal Unblocking Key)

Some tokens auto-unlock after 24 hours

For permanent lock, token replacement may be required

DSC Security Best Practices for Business Owners and Directors

Protecting your Class 3 DSC is crucial as it legally represents your signature.

Physical Security:

Store USB token securely: Keep in a safe or locked drawer when not in use

Never share your token: Each person must have their own DSC

Create strong password: Change default token password immediately after receiving

Backup strategy: Consider obtaining a duplicate token from your CA

Operational Security:

Use only on trusted computers: Avoid public or shared computers

Install antivirus software: Protect against malware and keyloggers

Enable firewall: Prevent unauthorized network access

Log out after use: Always eject token and close browser sessions

Monitor usage logs: Check filing history on portals for unauthorized use

Legal Compliance:

Report loss immediately: Contact CA and file police complaint if token is stolen

Revoke compromised certificates: Request immediate revocation from CA

Maintain documentation: Keep all invoices and certificates for audit trails

Renewal reminders: Set calendar alerts 30 days before expiry

Class 3 DSC for Specific Use Cases

For Company Directors (MCA Compliance):

Mandatory Forms Requiring DSC:

Form INC-20A (Commencement of Business)

Form MGT-7 (Annual Return)

Form AOC-4 (Financial Statements)

Form DIR-3 KYC (Director KYC)

Board resolutions and special resolutions

Best Practice: All active directors should obtain individual Class 3 DSCs linked to their DIN.

For Chartered Accountants:

Use Cases:

Signing audit reports (Form ADT-1)

Certification of financial statements

Income tax audit reports

GST audit reports

MSME Form 1 certifications

Recommendation: Class 3 Sign & Encrypt with membership number linked.

For GST Compliance:

When DSC is Mandatory:

Annual turnover exceeds ₹5 crores

Filing GSTR-9 (Annual Return)

Filing GSTR-9C (Reconciliation Statement certified by CA/CMA)

Input Service Distributor (ISD) registrations

Authentication Process: DSC must be registered on GST portal for EVC (Electronic Verification Code) generation.

For Import-Export Businesses:

DGFT Portal Requirements:

Applying for Import Export Code (IEC)

Filing shipping bills

Advance Authorization applications

EPCG (Export Promotion Capital Goods) applications

Portal: https://dgft.gov.in - Requires Class 3 DSC registration.

Class 3 DSC Renewal Process (2025)

DSC certificates typically have 1-3 year validity. Here's how to renew:

When to Renew:

Start renewal process 30-45 days before expiry

Expired DSCs cannot be used for any portal authentication

Late renewal may delay critical filings

Renewal Steps:

Contact Your CA: Email or call your original Certifying Authority

Submit Renewal Request: Provide existing certificate details

Video KYC Verification: Mandatory even for renewals (post-July 2024)

Updated KYC Documents: Submit fresh photographs and address proof if changed

Payment: Renewal costs are usually 20-30% less than new certificates

Token Reuse: Your existing USB token can be reused; CA will install new certificate

Portal Re-registration: Must re-register renewed DSC on all portals

Renewal Costs:

Class 3 Signing (1 year renewal): ₹799 - ₹999

No USB token cost if reusing existing one

Future of Digital Signatures in India (2025 and Beyond)

Aadhaar-Based e-Sign:

The government is promoting Aadhaar e-Sign as an alternative to DSC for certain low-risk documents. However, Class 3 DSC remains mandatory for:

MCA statutory filings

High-value tender submissions

Audit report certifications

Digital Locker Integration:

DigiLocker is being integrated with government portals for seamless document verification, but DSC authentication remains separate.

Blockchain-Based Certificates:

The CCA is exploring blockchain technology for certificate issuance and verification to enhance security and reduce fraud.

People Also Ask (FAQ Section)

Is DSC mandatory for private limited companies?

Yes, Class 3 Digital Signature Certificates are mandatory for private limited companies. Directors must use DSC to file annual returns (Form MGT-7), financial statements (Form AOC-4), and other statutory compliance forms on the MCA V3 Portal. At least one director must possess a valid Class 3 DSC for ROC filings.

What is the validity of Class 3 DSC?

Class 3 Digital Signature Certificates are available with 1-year, 2-year, or 3-year validity periods. Most business owners opt for 2-year validity for cost-effectiveness. The validity period starts from the date of issuance by the Certifying Authority. You must renew your DSC before expiry to avoid filing disruptions.

How to fix 'Certificate not to be trusted' error?

The "Certificate not to be trusted" error occurs when root and intermediate certificates are not installed on your computer. To fix this: (1) Download root and intermediate certificates from your CA's website, (2) Open Windows Certificate Manager (certmgr.msc), (3) Install root certificate under "Trusted Root Certification Authorities", (4) Install intermediate certificate under "Intermediate Certification Authorities", (5) Restart your browser. This establishes the complete certificate chain.

Can I use one Class 3 DSC for multiple companies?

Yes, if you're a director in multiple companies, you can use the same individual Class 3 DSC (linked to your DIN) for filing forms across all companies. However, each company's authorized signatory must have their own DSC. You cannot share your personal DSC with others.

What is the difference between Class 2 and Class 3 DSC?

As of 2024, Class 2 DSCs are discontinued for government portal authentication. Class 3 DSC offers higher security with mandatory physical verification and biometric authentication. Class 3 is legally required for MCA, GST, and income tax filings, while Class 2 was primarily used for lower-risk applications. All existing Class 2 holders must upgrade to Class 3.

How long does it take to get a Class 3 DSC?

After completing the video KYC verification and document submission, Class 3 DSC issuance takes 3-7 working days. The USB token is delivered via courier to your registered address. Emergency processing is available from some CAs for an additional fee (24-48 hours delivery). Processing time may extend during peak filing seasons (March-April for income tax, September for company filings).

Can I use Class 3 DSC on multiple computers?

Yes, Class 3 DSC stored on a USB token can be used on any computer. You need to install the required software (Java, emSigner, USB token driver) on each computer. Simply insert the USB token, enter your password, and authenticate. However, for security reasons, use DSC only on trusted computers, never on public or shared systems.

What happens if I lose my DSC USB token?

If you lose your DSC USB token: (1) Immediately contact your Certifying Authority to revoke the certificate, (2) File a police complaint (FIR), (3) Submit revocation request with FIR copy to CA, (4) Apply for a fresh DSC with new token. The revoked certificate becomes invalid instantly across all portals. Keep your CA's contact details handy for emergency revocation.

Is video KYC mandatory for DSC in 2025?

Yes, as per the July 2024 Identity Verification Guidelines (IVG) issued by the Controller of Certifying Authorities, video KYC verification is mandatory for all new DSC applications and renewals. You must schedule a live video call with the CA representative who will verify your identity and original documents. This process typically takes 10-15 minutes.

What is the cost of Class 3 DSC in 2025?

Class 3 DSC costs vary by validity period: 1-year signing certificate costs ₹999-₹1,200; 2-year costs ₹1,599-₹1,999; 3-year costs ₹2,500-₹3,000. Class 3 Sign & Encrypt certificates cost ₹200-₹300 more. USB token (epass2003) costs ₹300-₹500 extra but is reusable for renewals. Prices vary across Certifying Authorities; compare offerings before purchasing.

Schema Markup Suggestion

{

"@context": "https://schema.org",

"@type": "FAQPage",

"mainEntity": [

{

"@type": "Question",

"name": "Is DSC mandatory for private limited companies?",

"acceptedAnswer": {

"@type": "Answer",

"text": "Yes, Class 3 Digital Signature Certificates are mandatory for private limited companies. Directors must use DSC to file annual returns (Form MGT-7), financial statements (Form AOC-4), and other statutory compliance forms on the MCA V3 Portal. At least one director must possess a valid Class 3 DSC for ROC filings."

}

},

{

"@type": "Question",

"name": "What is the validity of Class 3 DSC?",

"acceptedAnswer": {

"@type": "Answer",

"text": "Class 3 Digital Signature Certificates are available with 1-year, 2-year, or 3-year validity periods. Most business owners opt for 2-year validity for cost-effectiveness. The validity period starts from the date of issuance by the Certifying Authority. You must renew your DSC before expiry to avoid filing disruptions."

}

},

{

"@type": "Question",

"name": "How to fix Certificate not to be trusted error?",

"acceptedAnswer": {

"@type": "Answer",

"text": "The Certificate not to be trusted error occurs when root and intermediate certificates are not installed on your computer. To fix this: (1) Download root and intermediate certificates from your CA's website, (2) Open Windows Certificate Manager (certmgr.msc), (3) Install root certificate under Trusted Root Certification Authorities, (4) Install intermediate certificate under Intermediate Certification Authorities, (5) Restart your browser."

}

},

{

"@type": "Question",

"name": "What is the cost of Class 3 DSC in 2025?",

"acceptedAnswer": {

"@type": "Answer",

"text": "Class 3 DSC costs vary by validity period: 1-year signing certificate costs ₹999-₹1,200; 2-year costs ₹1,599-₹1,999; 3-year costs ₹2,500-₹3,000. Class 3 Sign & Encrypt certificates cost ₹200-₹300 more. USB token (epass2003) costs ₹300-₹500 extra but is reusable for renewals."

}

},

{

"@type": "Question",

"name": "Is video KYC mandatory for DSC in 2025?",

"acceptedAnswer": {

"@type": "Answer",

"text": "Yes, as per the July 2024 Identity Verification Guidelines (IVG) issued by the Controller of Certifying Authorities, video KYC verification is mandatory for all new DSC applications and renewals. You must schedule a live video call with the CA representative who will verify your identity and original documents."

}

}

]

}

Conclusion: Your Next Steps

Class 3 Digital Signature Certificates are non-negotiable for Indian businesses operating in 2025. With the discontinuation of Class 2 certificates and stricter IVG guidelines introduced in July 2024, ensuring compliance is more important than ever.

Immediate Action Items:

Verify Your Current DSC: Check validity and whether it's Class 3

Upgrade if Using Class 2: Apply for Class 3 DSC immediately

Register on All Portals: Ensure DSC is active on MCA, GST, and income tax portals

Install Required Software: Java, emSigner, and DSC utilities

Set Renewal Reminders: Mark calendar 30 days before expiry

Secure Your Token: Implement physical and digital security measures

For Professional Assistance:

Consult your Chartered Accountant for DSC requirements specific to your business

Contact licensed Certifying Authorities for technical support

Refer to the Controller of Certifying Authorities (CCA) website for latest guidelines

By following this comprehensive guide, you'll navigate the Class 3 DSC ecosystem with confidence, ensuring seamless statutory compliance and avoiding last-minute filing complications.

Document Version: 2025.1

Last Updated: Based on July 2024 IVG Guidelines

Regulatory References: IT Act 2000, Companies Act 2013, CCA Guidelines, MCA Circulars

This article is for informational purposes only and does not constitute legal or financial advice. Consult qualified professionals for specific compliance requirements.